Understanding Drug Pricing from Divergent Perspectives: State of Washington Prescription Drug Pricing Analysis

In the United States, patients grapple with a sense of bewilderment over the opaque nature of drug pricing, fueling a pervasive feeling of helplessness amidst soaring healthcare costs. There's a prevailing perception that every link in the drug supply chain prioritizes profit margins over patient well-being, amplifying the strain on individuals who must make agonizing choices between vital medications and basic necessities. The stark reality of this dilemma reverberates across social media platforms, serving as a poignant reminder of the profound affordability challenges plaguing the healthcare system. This reality fuels an escalating demand for comprehensive reforms to revolutionize how medicines are procured in the nation.

Despite a decade of federal and state initiatives aimed at mitigating the impact of escalating drug prices, public frustration persists unabated. What adds to the confounding nature of the issue is the paradox wherein some individuals express satisfaction with their health coverage while concurrently advocating for payment reforms. The intricate labyrinth through which medications are bought and sold is shrouded in secrecy, fostering a climate ripe for sowing seeds of distrust.

Into this environment, we conducted a study of the pharmacy benefits and reimbursement trends within the state of Washington. For the first time ever within our publicly available research work, we have the opportunity to not just analyze drug pricing trends from the perspective of pharmacy providers who buy and sell medications to patients, but also from commercial plan sponsors, who provide the majority of individuals with their access to prescription drug insurance.

In our newly released analysis of more than nine million prescription drug claims from both small retail pharmacies and commercial employers in the state of Washington from 2020 to 2023, we found that pharmacies and plan sponsors have relatively divergent perspectives on the rate of change of prescription drug prices within the state of Washington.

From this observation, we identified that one of the key drivers for the diverging perspective on drug prices was the fact that brand and generic prices were not aligned, with retail pharmacy providers generally seeing lower brand reimbursement relative to the plan sponsor experience.

Our report identified one possible explanation for these divergent perspectives – the potential presence of “spread pricing.” Spread pricing is the practice where the pharmacy benefit managers (PBMs) that are tasked with setting the pricing experiences on both ends of the transaction are in general, reimbursing pharmacies one price while billing plan sponsors a different price. While in general, we identified around a $4 per prescription gap between what our studied Washington retail pharmacies were paid for medicines versus what commercial plan sponsors are being charged, those takeaways are just directional comparisons based upon the independent experiences of both studied data sets.

Given the bevy of claims data we received for this analysis, we actually identified more than 20,000 claims where we have great confidence that the payment to the pharmacy for a particular claim is linked to a charge to a plan sponsor for the same claim, giving us the ability to assess spread totals in a subset of likely-matched claims between our study data sets. Within this subset of claims, we found a more than $8 per prescription gap between what retail pharmacies were paid versus what plan sponsors were charged.

In one example of how spread pricing can exacerbate disconnects in drug pricing experiences, while retail pharmacies were paid $18.77 below their acquisition cost for the popular addiction treatment medication buprenorphine-naloxone SL (generic Suboxone), plan sponsors were charged $100.12 above the underlying drug cost.

We also found other compelling takeaways that could further explain the divergent perspectives of brand and generic prices. While plan sponsors clearly would identify brand-name drugs as a key driver of their overall gross health expenditures; pharmacies are likely to identify generic drug pricing challenges as the key driver impacting the long-term viability of their business. For example, within the retail pharmacy data we analyzed, brand drugs accounted for 71% of total sales for the retail pharmacy data set but represented just 4% of estimated retail pharmacy margin whereas as generic drugs were 29% of sales and 96% of margin. Said differently, a slight reduction in generic reimbursement might not appear as impactful to overall plan sponsors but may be make-or-break propositions to retail pharmacies.

“Prescription drugs is the fastest growing spend for our total cost of care at the Association of Washington Cities Employee Benefit Trust. In order to meet our fiduciary responsibility to the insured members, we must lift the veil on opaque drug pricing to achieve real price transparency.”

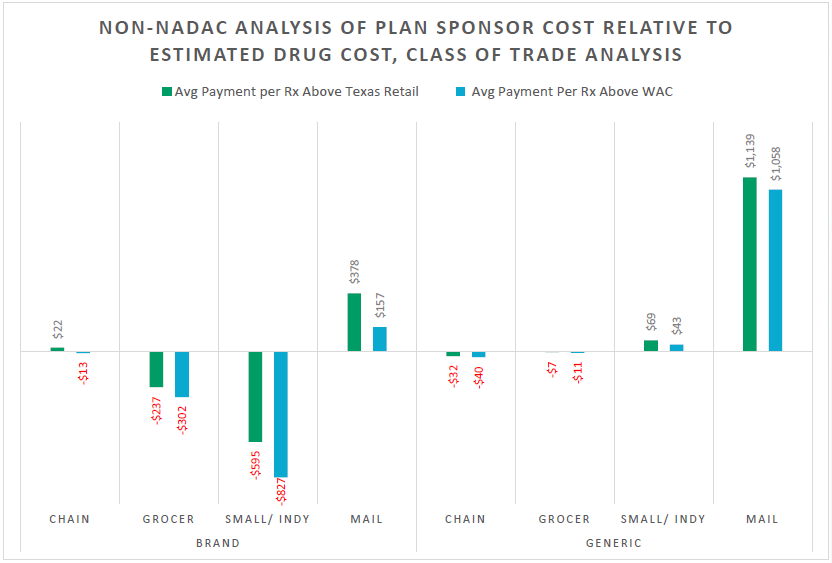

The observation of differing priorities related to drug prices is potentially helpful to explaining why historic prescription drug pricing reform attempts have not been universally recognized as successful. The recognition that plan sponsors and pharmacies have potentially conflicting realities, despite servicing effectively the same group of consumers, led us to investigate variability of drug prices by pharmacy class of trade. In essence, if the small chain and independent pharmacies that participated in our study are experiencing reimbursement pressure, but the employers that participated in our study are feeling cost pressure, we wanted to see if other types of pharmacies were experiencing similar trends or conversely, if other types of pharmacies were driving more costs to the plan sponsors than others.

Class of trade is a nebulous term that recognizes that the value of leveraged pricing discounts (the principal way that we price drugs within contracts) fails to treat the same drug equally (on the basis of a drug’s price) based simply upon differences in where the medication costs were incurred. Said differently, class of trade distinctions acknowledge that the value or pricing of drugs may differ depending on where they are dispensed or sold, such as retail pharmacies, specialty pharmacies, or mail-order pharmacies and not what is being sold (i.e., the underlying drug is the same, but price is different based on the location from where it is obtained). This recognition led us to evaluate multiple ways in which traditional retail drugs end up with variable costs for commercial plan sponsors within Washington.

In that vein, we found that when it comes to the dispensing of medicines that typically flow through the retail channel, the greatest beneficiary from a profitability perspective would appear to be non-retail pharmacies. On generic drugs, the studied Washington plan sponsor data suggests that the average markups on these medicines in the mail-order channel are more than four times the estimated margins yielded by grocery store pharmacies. Meanwhile, for brand drugs, the studied Washington plan sponsor data suggests that the average markups on these medicines in the mail-order channel are more than 35 times the estimated margins yielded by small chain and independent pharmacies.

One example explored within this report was for the multiple sclerosis medication teriflunomide (generic Aubagio). Teriflunomide products have relatively similar drug prices (as measured by AWP); however, the cost of this medication can vary significantly depending upon whether it is dispensed by a cost-plus mail pharmacy or a PBM-affiliated specialty mail-order pharmacy. Our analysis found plan sponsors being charged an average of $4,465 per teriflunomide prescription at PBM-affiliated mail-order pharmacies despite the same drug being available at Mark Cuban Cost Plus Drug Company for less than $20.

This was just one example where drugs that are typically being pushed outside of the retail channel by PBMs can result in significant markups relative to the underlying cost of the medicines. In looking at a subset of drugs that lack pricing visibility in the retail pharmacy channel, we found the typical mail-order pharmacy making roughly 20-times more margin relative to the estimated underlying drug cost for brand drugs and roughly 1,000-times more margin for generic drugs.

Such pricing activity appears to occur separately and apart from the underlying drug manufacturer-set prices, as even the same NDCs can have different prices on the same day (both within the studied pharmacy provider data and plan sponsor data). The divergent nature of drug costs in these respects is an often uninvestigated and understudied aspect of our nation’s unique drug pricing paradigm.

In conclusion, our report identifies that drug pricing is a complicated endeavor subject to many potential competing incentives. It has become evident that meaningful reforms to the landscape of drug pricing are improbable as long as the process remains enshrouded in secrecy, hindering comprehensive and transparent evaluation. The phenomenon whereby the same medication, dispensed on the same day, for the same health plan can have potentially variable costs underscores the systemic dysfunction that pervades the current framework of U.S. drug pricing. In such an environment of variable costs, the outcomes are predictably unpredictable – undermining the efficacy of relying solely on competitive financial forces to rectify the prevailing cost disparities that our report highlights.

At 3 Axis Advisors, we understand that health care is unnecessarily complex and exceedingly expensive. With precious financial resources and the care of our loved ones on the line, we believe that through a better comprehension of our system’s mechanics and incentives, a better healthcare system is possible.

Driven by our experience, innate curiosity, and passion for finding truth, we expose and simplify inefficiencies and cost-drivers in the prescription drug supply chain and work to remedy them through data-driven research and innovative solutions.

We hope that the insights contained in this report can build upon previous net drug pricing research and help to better shorten the bridge between understanding and misunderstanding the cost drivers within the prescription drug supply chain.

A big thanks to the Washington State Pharmacy Association for their support and sponsorship of this important drug pricing research. Additional thanks to the Washington Health Alliance for their partnership in this project, and lastly, we would like to thank the many pharmacy organizations and employers who agreed to participate in our study.