Cash flow analysis of the 340B rebate model

As the 340B Drug Pricing Program approaches its 30th anniversary, the program will likely remain in the political spotlight as the various drug pricing factions continue to debate the program’s merits, which is intended to use the sale of deeply discounted medications from drug manufacturers that participate in Medicaid as a financial means for qualified health care organizations to provide care for low-income individuals.

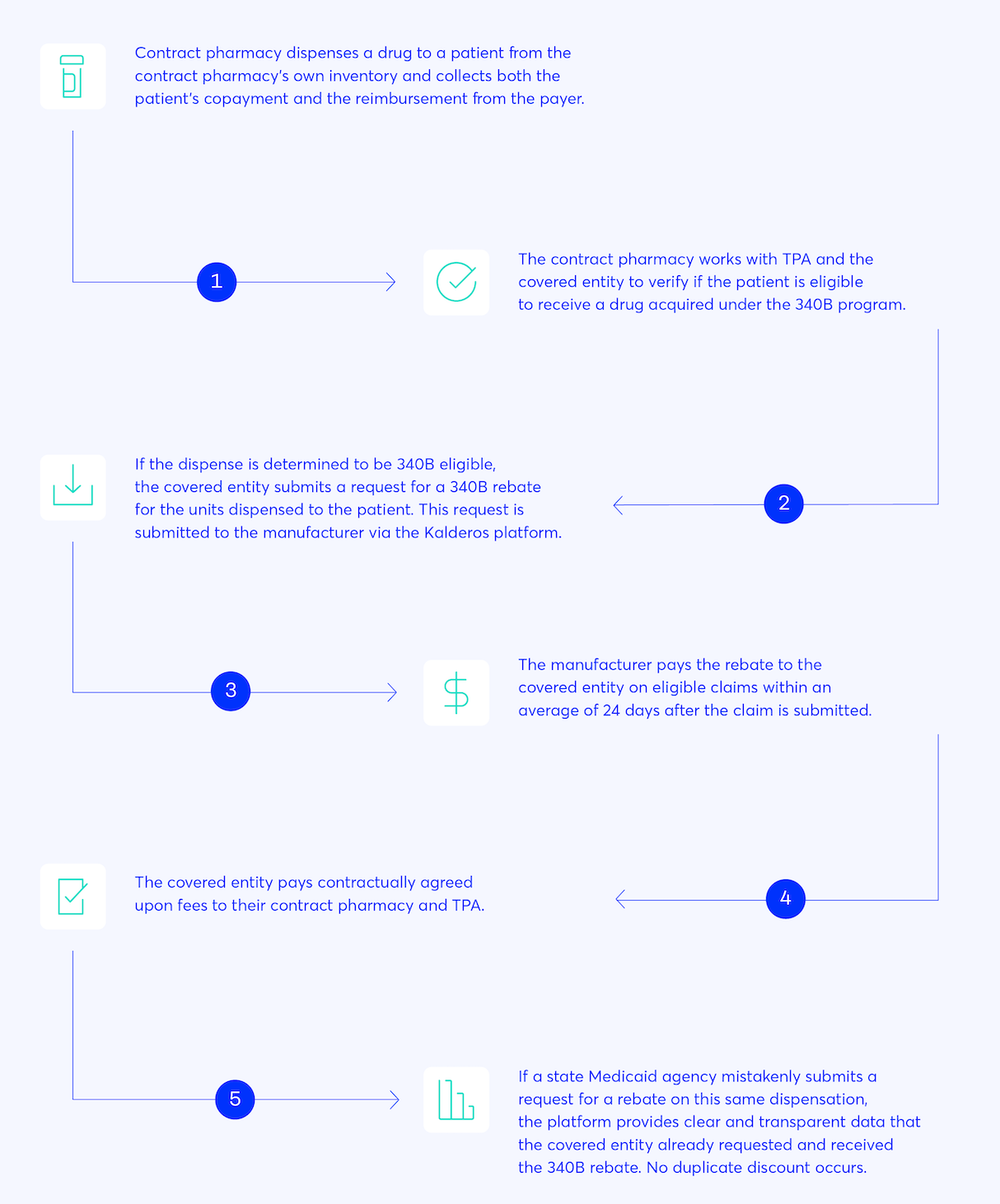

The mechanics and operational impacts of the 340B rebate model

Source: Kalderos

Since the program’s inception, there have been debates over the importance of the program. Is the growth in the number of 340B sites, which has seen a 20-year compounded annual growth rate (CAGR) of 7.87%, a sign of the program’s vital need? Or does such growth demonstrate that the U.S. healthcare system will always grow in the direction of opacity and pricing arbitrage?

The Kalderos 340B rebate model’s goal is to add transparency to the program’s pharmacy transactions in a manner that is sustainable for covered entities. The Kalderos program converts a prescription drug purchasing discount predicated on “buying low and selling high” to a retroactive rebate not unlike that seen in other programs such as the Medicaid Drug Rebate Program (MDRP) or other government subsidies. Furthermore, the conversion of the 340B purchasing discounts to a more accountable retroactive rebate may better position the 340B program in an era that hopes to see broader U.S. health policy changes designed at increasing the affordability of drugs for all Americans, both with and without insurance.

3 Axis Advisors, LLC (3 Axis) was commissioned to study the potential cash flow impacts of the 340B rebate model proposed by Kalderos.

Overall, 3 Axis finds the 340B rebate program proposed by Kalderos to be cash flow positive for a covered entity within the assumptions of our report.

Projected positive cash flow is resulting from a few principal sources, namely:

the decrease in the time it takes for a covered entity to recognize the dollars generated from its relationships with 340B contract pharmacies,

the lower inventory carrying costs within the 340B rebate model, as covered entities are no longer purchasing extra inventory to deliver to the contract pharmacy and,

the potential for higher 340B revenues that results from a 340B rebate based upon Wholesale Acquisition Cost (WAC) versus the existing commercial reimbursement rates which are predicated upon a discount to Average Wholesale Price (AWP)

The sensitivity analysis conducted demonstrated a positive cash flow for a covered entity in all scenarios tested adding a reasonable degree of confidence to this conclusion.

"Based upon the assumptions in the report, our model demonstrated positive cash flow for covered entities with the Kalderos 340B rebate model relative to the existing replenishment models," said 3 Axis Advisors vice president of pharmacy Ben Link.

If you have questions about this report, please contact us at info@3axisadvisors.com. For more information about Kalderos and this unique 340B rebate model, please visit www.kalderos.com.

OTHER COVERAGE

Kalderos: Study shows 340B rebates would boost hospital cash flow

Inside Health Policy, 11/12/21

Kalderos 340B rebate model improves covered entity cash flow, study by 3 Axis Advisors confirms

Kalderos blog, 11/2/21